In today's digital age, payment systems are the backbone of commerce. They enable quick transactions across the globe. However, with convenience comes the risk of security breaches.

POS systems are particularly vulnerable to cyber threats. These systems handle sensitive customer data, making them prime targets for fraudsters. Ensuring robust POS security is crucial for businesses.

Embedded terminals offer enhanced connectivity and convenience. But they also introduce new security challenges. Protecting these systems requires a comprehensive approach.

POS fraud prevention is more important than ever. Businesses must adopt advanced security measures to safeguard transactions. This includes encryption, tokenization, and secure network protocols.

Payment processing security is not just about technology. It involves people, processes, and compliance with regulatory standards. A holistic strategy is essential for success.

Understanding and implementing these security measures can protect businesses. It builds customer trust and ensures long-term growth.

Understanding Payment Systems Security

Payment systems security is essential in preventing data breaches. It involves both hardware and software protections. These measures defend against unauthorized access and cyber threats.

Hardware security is fundamental. It includes physical protection of terminals and secure connections. Embedded terminals should be tamper-proof to deter physical attacks. This ensures transactions are processed without interference.

Software security focuses on safeguarding data. It employs encryption, firewalls, and antivirus software. These tools protect sensitive information from malicious actors. Regular software updates are crucial for mitigating new vulnerabilities.

Implementing these components is just one part of the solution. Businesses must also ensure secure communication. This involves secure networks and protocols for data exchange. Without these, systems remain exposed to cyber threats. Effective POS security relies on a layered approach combining all these elements.

Key Threats to POS Systems and Embedded Terminals

POS systems face numerous threats that can compromise security. Cybercriminals are increasingly targeting these systems to steal sensitive information.

One major threat is POS malware. This malicious software can capture card data during transactions. It's often undetected until significant damage is done.

In addition, data breaches can occur due to weak network security. POS systems often connect to broader networks, which can introduce vulnerabilities. Without proper network segmentation, a breach in one area can affect the entire system.

Physical tampering of embedded terminals poses another risk. Terminals can be altered to capture card data or insert malicious software. Protecting against these threats requires comprehensive security strategies.

Common threats to POS systems include:

- POS Malware: Steals data during transactions.

- Network Vulnerabilities: Allows unauthorized access.

- Physical Tampering: Alters terminals to capture information.

Mitigating these threats involves both technological and procedural safeguards. Regular audits and monitoring can detect vulnerabilities early, minimizing impact.

The Role of Connectivity in POS Security

Connectivity is crucial to POS system efficiency and security. Reliable connections ensure transactions are smooth and secure. They also enable real-time monitoring for potential threats.

However, connectivity introduces risks. Unsecured networks can expose systems to cyber attacks. Secure payment systems need to protect data as it transfers across networks.

To enhance security, it's essential to use robust protocols. Encrypting data during transmission helps to shield it from interception. Additionally, secure network configurations can minimize vulnerabilities and unauthorized access.

Key aspects of secure connectivity include:

- Data Encryption: Protects information during transfer.

- Secure Protocols: Ensures safe data transmission.

- Network Configurations: Helps prevent unauthorized access.

Implementing secure connectivity measures enhances both security and customer trust. It reduces the potential for breaches and data theft. This fosters a reliable payment environment for businesses and clients alike.

Core Principles of Payment Processing Security

Payment processing security is vital to protecting customer data. Businesses must focus on key principles to secure transactions effectively.

Encryption is a cornerstone of payment security. It protects sensitive data from unauthorized access by making it unreadable to outsiders.

Another essential practice is implementing multi-factor authentication. This adds an additional layer of protection by requiring multiple forms of verification.

Tokenization is also crucial in safeguarding transactions. It replaces sensitive information with unique identifiers, reducing the risk of data exposure.

Important principles of payment processing security include:

- Encryption: Ensures data privacy.

- Multi-Factor Authentication: Enhances access control.

- Tokenization: Minimizes exposure of critical data.

By adhering to these principles, businesses can create a secure environment for payment processing. This approach not only protects the company but also fosters consumer confidence. Securing payment processes is an ongoing commitment critical for success.

POS Fraud Prevention: Best Practices and Technologies

POS fraud is a significant risk for businesses today. Implementing effective prevention measures is crucial to safeguarding transactions.

One fundamental strategy is data encryption. This technology ensures that information is unreadable if intercepted by hackers.

Network segmentation is another critical method. By isolating POS systems from other network components, businesses can limit the spread of any potential breach.

Advanced technologies like EMV chip cards and contactless payments offer enhanced security. These methods reduce the potential for counterfeit transactions.

Businesses should also focus on real-time monitoring. This involves actively tracking transactions to detect and respond to suspicious activities quickly.

Technologies Boosting Security:

- EMV Chip Cards: Reduce counterfeit risks.

- Contactless Payments: Provide secure alternatives.

Adopting these practices and technologies can significantly mitigate fraud risks. A proactive approach to security ensures a safer environment for customers and businesses alike. Regular updates and staff training further strengthen defenses against POS fraud. By staying informed and prepared, companies can effectively protect their interests.

Essential Security Features for Embedded Terminals

Embedded terminals are integral to modern POS systems. They require robust security to protect sensitive transaction data.

One essential feature is secure boot processes. These ensure only trusted software runs on the terminal, preventing unauthorized changes.

Secure connectivity is crucial for embedded terminals. It prevents unauthorized network access and supports data integrity.

Encryption is another key element. It protects data both during transmission and at rest, making it unreadable to unauthorized users.

Key Security Features:

- Secure Boot Processes: Ensure trusted software execution.

- Secure Connectivity: Maintains data integrity and prevents breaches.

- Encryption: Safeguards data in transit and storage.

Integrating these features into embedded terminals fortifies payment processing security. By emphasizing these elements, businesses can offer a secure transaction experience. Continuous innovation and implementation of these security measures help maintain customer trust and enhance business reputation.

Compliance and Regulatory Standards (PCI DSS, EMV, GDPR)

Adhering to compliance standards is crucial for POS systems. Compliance ensures security and trust in payment processing.

PCI DSS is a set of security standards. It protects cardholder data and applies to any business processing card payments.

EMV technology enhances security through chip cards. These cards are less prone to fraud than magnetic strip cards.

GDPR impacts businesses handling EU citizens' data. It mandates data protection and privacy for individuals.

Key Compliance Standards:

- PCI DSS: Security standards for cardholder data protection.

- EMV: Chip technology for secure transactions.

- GDPR: Data protection and privacy for EU citizens.

Maintaining compliance with these standards is vital. It safeguards businesses against security breaches and financial penalties. Regular audits and updates ensure continual adherence.

Employee Training and Access Control

Employee awareness is a vital component of POS security. Training helps in identifying and mitigating threats effectively.

Access control ensures only authorized users handle sensitive systems. This prevents unauthorized entry and potential data breaches.

Implementing stringent protocols is crucial for protecting transactions. Regular training sessions keep employees informed about evolving threats.

Access Control Strategies:

- Restrict Access: Limit system access to essential personnel.

- Regular Reviews: Update access permissions periodically.

- Multi-factor Authentication: Add additional layers of security.

Together, training and access control form a robust defense. They are essential in maintaining payment systems' integrity and security.

The Future of POS Security: Trends and Innovations

POS security is evolving rapidly to counteract emerging threats. New technologies offer enhanced protection and streamlined processes.

Artificial Intelligence (AI) plays a growing role in fraud detection. It analyzes transactions in real time to identify anomalies.

Contactless and mobile payments demand stronger security measures. Tokenization and biometric authentication are becoming standard.

The integration of blockchain technology is also notable. It promises secure and transparent transaction records, enhancing trust.

Emerging Trends in POS Security:

- AI-Driven Threat Detection: Enhances accuracy in spotting fraud.

- Blockchain Adoption: Increases transparency and security.

- Biometric Verification: Offers robust identity confirmation.

These innovations reflect the dynamic nature of payment systems security. Adopting them can give businesses a competitive edge. Staying informed about these trends is crucial for future-proofing POS systems.

Building a Holistic POS Security Strategy

Creating a comprehensive POS security strategy involves several key components. It is not just about technology but also processes and people. This approach can help businesses cover all bases.

Businesses must focus on a multipronged plan. Regular security audits and updates are vital to address vulnerabilities. Ensuring compliance with standards such as PCI DSS is crucial.

Key Elements of a Holistic Security Strategy:

- Regular Security Updates: Patching software to fix vulnerabilities.

- Employee Training Programs: Educating staff about threats and prevention.

- Incident Response Plans: Preparing for potential security breaches.

This holistic approach helps protect sensitive data and builds customer trust. By understanding and integrating these elements, businesses can better safeguard their payment systems. A well-rounded strategy enhances resilience against evolving threats.

Securing Payment Systems for Business Success

In today's digital landscape, securing payment systems is crucial for business sustainability. By prioritizing both security and connectivity, businesses can safeguard customer data and build trust.

A strong security strategy encompasses modern technologies, compliance, and employee awareness. Implementing these measures not only mitigates risks but also enhances the customer experience.

Ultimately, secure payment systems are integral to thriving in the competitive market. Businesses that invest in robust security measures position themselves for long-term success and customer loyalty.

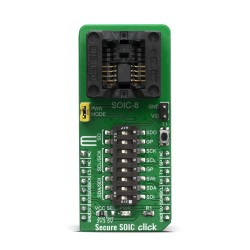

Accelerate Your POS Development with MIKROE

From secure hardware encryption to wireless communication (RFID/NFC) and sleek user interfaces, MIKROE offers Click boards™ compatible with the mikroBUS™ standard - perfect for building modular and secure POS terminals. Pair them with our Fusion or UNI-DS v8 development boards and streamline your firmware development in NECTO Studio.

EXPLORE EMBEDDED PAYMENT TERMINAL PROJECTS ON EMBEDDEDWIKI

To see how these components come together in real-world applications, visit EmbeddedWiki. There you’ll find working examples of POS and payment-related projects built with the same Click boards featured in this blog. These projects include full source code, schematics, and hardware integration guides, helping you implement features like contactless payments, secure data storage, PIN entry, or receipt printing with ease.

Whether you're building a standalone POS device or integrating payment functionality into a larger system, EmbeddedWiki is your go-to knowledge base for embedded financial technology.

ABOUT MIKROE

MIKROE is committed to changing the embedded electronics industry through the use of time-saving industry-standard hardware and software solutions. With unique concepts like Remote Access, One New Product/Day, Multi-Architectural IDE and most recently, the EmbeddedWiki™ platform with more than million ready-for-use projects, MIKROE combines its dev boards, compilers, smart displays, programmers/debuggers and 1850+ Click peripheral boards to dramatically cut development time. mikroBUS™; mikroSDK™; SiBRAIN™ and DISCON™ are open standards and mikroBUS only has been adopted by over 100 leading microcontroller companies and integrated on their development boards.

Your MIKROE

%20Security%20and%20Connectivity%20in%20Embedded%20Terminals%20-%201.jpg)

%20Security%20and%20Connectivity%20in%20Embedded%20Terminals%20-%202.jpg)

%20Security%20and%20Connectivity%20in%20Embedded%20Terminals%20-%203.jpg)